Opportunity In the Midst of Adversity

If you look hard enough, there’s often a silver lining in many adversities. So is the case

with regard to E-Commerce sales in the People’s Republic of China. In 2022,

ecommerce sales reached 15.5 CNY trillion (more than $2 Trillion). This made China the largest e-commerce market in the world. When Covid-19 literally froze daily life and factory

production in its tracks, Chinese consumers found a way to continue their shopping activities while avoiding physical shopping. The result was a major lift in annual e-commerce sales. The industry grew to $2 Trillion per year. Chinese consumers increasingly shopped online for their favorite foreign fashion, accessories, and beauty products.

China’s E-commerce industry is currently growing at annual growth rate of 12.4%. In the next three years (by 2025), there will be 1.2 billion e-commerce shoppers in China. This growth is fueled by very strong growth in household internet penetration, which presently stands at 65.2%. While impressive, there’s still significant opportunity for growth left for household internet penetration, and e-commerce sales. There is one other thing that has investors in Chinese e-commerce companies anticipating great returns: cross border markets and the ability of Chinese e-tailers to reach them.

The Perfect Storm and the World’s Largest E-Commerce Market

In the presence of a few other factors, the Covid-19 pandemic yielded the world’s largest e-commerce market. These other factors included:

a) Alternative payment solutions, including Alipay and WeChat Pay. These two systems

accounted for 57.6% of total e-commerce value in 2021.

b) Market penetration of new technology, including internet, e-commerce platforms, and smartphones. China currently has more than 800 million internet users, more than the combined populations of the United States, Indonesia, and Brazil. 98% of the country’s total internet users shop online using their Smartphones. That’s twice the rate as in the United States.

c) Increasing consumer confidence in e-commerce companies and technology.

d) A huge migrant labor workforce employed by companies like Alibaba and JD.com enabling same-day delivery anywhere in China. Same-day delivery was hugely attractive to first time buyers and encouraged early adoption. For example, Alibaba manages a cross-country network of third-party delivery firms that can process up to 30 million items per day.

e) Nearly one-third of Chinese citizens now have a middle-class standard of living.

However, those who live in second-tier cities are faced with a lack of retail shopping locations, with limited options, consumers in lower-tier cities go online for more variety and options than they could ever have on their doorstep. E-commerce solutions have grown by meeting this previously unmet demand.

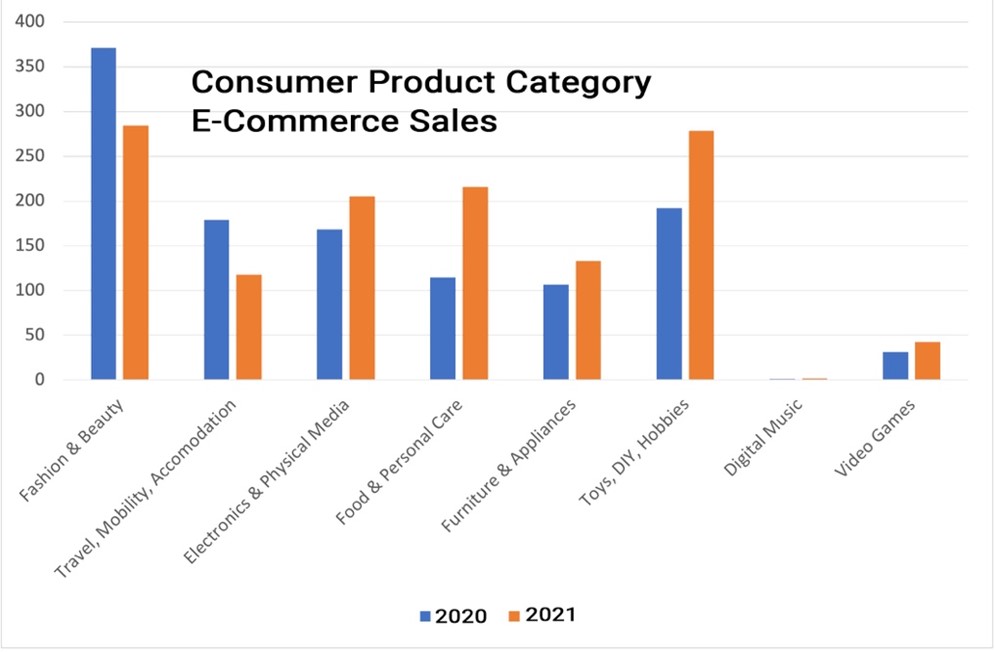

Shopping Patterns

Even as in our domestic (U.S.) economy, e-commerce is still largely a consumer product distribution strategy. The following provides a 2020 v. 2021 summary of the leading product categories and their growth. Note the growth across most categories.

One lesson that Word4Asia can take away from this is that adversity creates opportunity, if

businesses are prepared to see the signs, follow the trends, and take decisive action. We’ve

been helping clients with that perspective for over twenty years.

Perhaps this is your organization’s time for such action. If China is in your sights, we hope that you will consider us as a potential resource. We would be happy to open the conversation, share from our deep well of prior success, and work with you to achieve your objections. You can start that conversation with us by contacting Dr. Gene Wood at gene@word4asia.com.

All the best,

Gene